How Could a Recession Affect the Silver Price?

Although the outlook for the American economy is positive, for decades, every inflationary battle in the U.S. has resulted in a recession.

With silver outperforming gold in recent months, the iShares Silver Trust (SLV) ETF/ SPDR Gold Shares Trust (GLD) ETF ratio has rallied off its September lows. However, I’ve warned on numerous occasions that silver’s outperformance is bearish and often an ominous sign for the precious metals market.

Please see below:

Yet, because silver is more cyclical than gold, the white metal often outpaces the yellow metal during periods of economic optimism. Therefore, with recession fears dissipating as growth stabilized, the latest real GDP growth estimate from the Atlanta Fed has the silver permabulls brimming with confidence. For example, the report stated on Nov. 17:

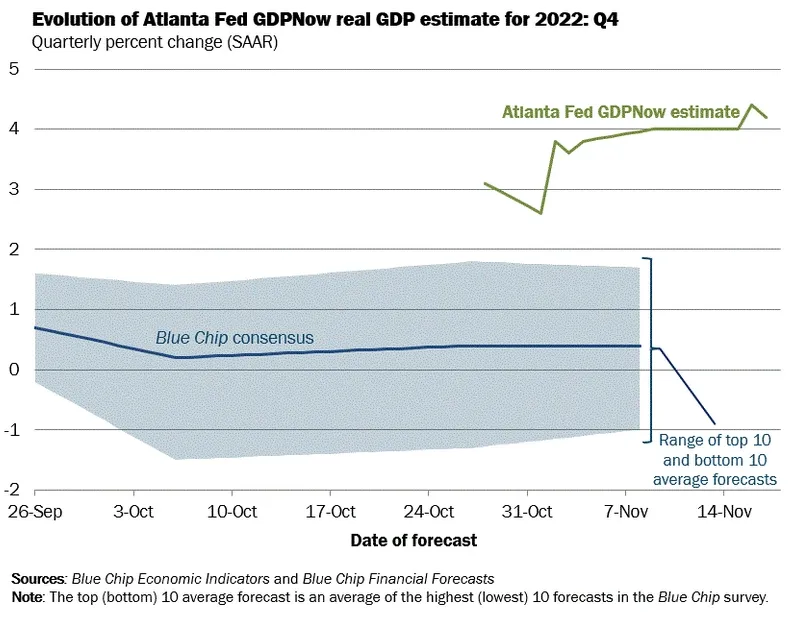

“The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2022 is 4.2 percent on November 17, down from 4.4 percent on November 16. After this morning’s housing starts report from the US Census Bureau, the nowcast of fourth-quarter real residential investment growth decreased from -7.6 percent to -11.7 percent.”

Please see below:

To explain, the green line above tracks the Atlanta Fed’s Q4 real GDP growth estimate, while the blue line above tracks the Blue Chip consensus estimate (investment banks). If you analyze the right side of the chart, you can see that the green line remains highly elevated and signals resilient growth ahead.

However, every U.S. inflation fight since 1954 has ended with a recession ; and while I’ve been bullish on the U.S. economy for some time, the actions required to normalize inflation should result in substantial economic weakness over the next 12 months, and economically-sensitive metals, like silver, should suffer more than gold when the tide turns.

Please see below:

To explain, the gray line above tracks the monthly movement of the silver futures price, while the red line above tracks the monthly movement of the copper futures price. If you analyze the relationship, you can see that they often follow in each other’s footsteps over the long term.

Furthermore, when the recession hit in 2001, it culminated with a ~20% decline in the silver futures price, while the 2007-2009 recession resulted in a ~46% drop, and the 2020 recession resulted in a ~23% drop. Consequently, while silver may seem like a solid momentum play when prices rise, the reversal can be just as violent on the downside.

Overall, with investors aiming to engineer a Santa Clause rally, their appetite for the worst-performing assets has increased. However, with history showing that silver often races ahead of gold before the bottom falls out, the medium-term outlook is much less bullish than it seems.

Alex Demolitor

Precious Metals Strategist